New signs that the recession could be nearing a bottom emerged Thursday, as factory orders were far better than expected and the Dow industrials surged over 8,000 for the first time in two months.

The Commerce Department said orders for manufactured goods rose 1.8 percent in February, reversing six straight monthly declines and easily beating estimates of another drop. Other economic indicators came in better than expected Wednesday, including construction spending and pending home sales.

Meanwhile, world leaders meeting in London on Thursday pledged $1.1 trillion to global institutions such as the International Monetary Fund to combat the downturn. And the European Central Bank agreed to cut a key interest rate to a record low of 1.25 percent.

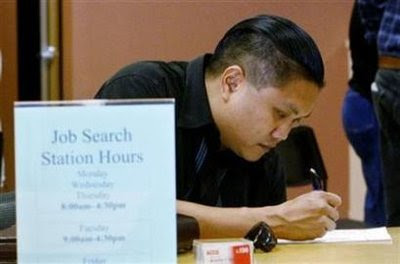

Still, the job situation remains grim. Traditionally, the labor market doesn't pick up until well after a recovery has started.

The monthly unemployment report due out Friday likely will be dismal, and new jobless claims reported Thursday were worse than expected.

The Labor Department said initial claims for unemployment insurance rose to a seasonally adjusted 669,000 from the previous week's revised figure of 657,000. That total was above analysts' expectations and the highest in more than 26 years, though the work force has grown by about half since then.

Financial stocks led a rally on Wall Street after the board that sets U.S. accounting standards gave banks and other companies more leeway when valuing assets and reporting losses. The Dow Jones industrial average added more than 290 points, or 3.8 percent, to 8,053 in afternoon trading, the first time it has risen above 8,000 since Feb. 10. Broader indices also surged.

Bank of America Chief Executive Ken Lewis also bolstered the financial markets when he told CNBC that the recession is "getting close to the bottom."

Still, economists said the jobless claims figures indicate that companies continue to lay off workers at a rapid pace.

"Claims are typically one of the very first indicators to signal economic recovery, and there is no sign of that in the data yet," Ian Shepherdson, chief U.S. economist at High Frequency Economics, wrote in a client note.

The tally of laid-off workers claiming benefits for more than a week rose 161,000 to 5.73 million, setting a record for the 10th straight week. That also was above analysts' expectations and indicates that unemployed workers are having difficulty finding new jobs. The continuing claims data lag the initial claims by one week.

An additional 1.5 million people received benefits under an extended unemployment compensation program Congress approved last year. That's as of March 14, the latest data available. Jobless benefits typically last 26 weeks, but the federal government is paying for an additional 20 to 33 weeks of compensation under the extended program, depending on each state's unemployment rate.

As a proportion of the work force, the number of people on the jobless benefit rolls is the highest since May 1983. The four-week moving average of jobless claims, which smooths out weekly volatility, rose to 656,750, the highest since October 1982, when the economy was emerging from a steep recession.

Employers are eliminating jobs and taking other cost-cutting measures to deal with sharp reductions in consumer and business spending. The current recession, now in its 17th month, is the longest since World War II.

Economists forecast that Friday's report will show employers cut 654,000 jobs in March, while the unemployment rate increased to 8.5 percent from 8.1 percent, according to a survey by Thomson Reuters.

Some economists raised their projection for job losses in March in response to the increase in claims. David Resler, chief economist at Nomura Securities International, said he now expects the department will report payroll cuts of 725,000 in March, up from a previous forecast of 680,000.

Companies reduced their payrolls by 651,000 jobs in February, a record third straight month of job losses above 600,000.

A private survey Wednesday said businesses cut 742,000 jobs in March. Employment at medium- and small-sized companies fell the sharpest — by a combined 614,000. The rest of the job cuts came from big firms — those with 500 or more workers_ according to the report from Automatic Data Processing Inc. and Macroeconomic Advisers LLC.

More job losses were announced this week. 3M Co., the maker of Scotch tape, Post-It Notes and other products, said Tuesday it's cutting another 1,200 jobs, or 1.5 percent of its work force, because of the global economic slump. Fewer than half the jobs will be in the U.S., but include hundreds in its home state of Minnesota. The 1,200 figure includes cuts made earlier in the first quarter.

Elsewhere, healthcare products distributor Cardinal Health Inc. said it would eliminate 1,300 positions, or about 3 percent of its work force, and semiconductor equipment maker KLA-Tencor Corp. said it will cut about 600 jobs, or 10 percent of its employees.

Among the states, California reported the biggest increase in new claims for the week ending March 21 with a jump of more than 6,700, which it attributed to layoffs in the construction and service industries. The next largest increases were in Missouri, Kansas, Oklahoma and Iowa, according to the Labor Department data.

The biggest drop was in Texas, which had 4,822 fewer claims as the trade, service, manufacturing and transportation industries cut fewer jobs. New York, Tennessee, Illinois and Virginia had the next largest declines.

The Federal Reserve has cut a key benchmark interest rate to nearly zero in an effort to jump-start lending and embarked on a series of radical programs to inject billions of dollars into the financial system.

The Obama administration's $787 billion stimulus package, approved by Congress in February, is trying to counter the recession by providing money for public works projects, extending unemployment benefits and helping states avoid budget cuts.

Showing posts with label jobless claims. Show all posts

Showing posts with label jobless claims. Show all posts

Thursday, April 2, 2009

Friday, February 6, 2009

Jobless rate jumps to 7.6 percent, 598K jobs lost

Recession-battered employers eliminated 598,000 jobs in January, the most since the end of 1974, and catapulted the unemployment rate to 7.6 percent. The grim figures were further proof that the nation's job climate is deteriorating at an alarming clip with no end in sight.

The Labor Department's report, released Friday, showed the terrible toll the drawn-out recession is having on workers and companies. It also puts even more pressure on Congress and President Barack Obama's administration to revive the economy through a stimulus package and a revamped financial bailout plan, both of which are nearing completion.

The latest net total of job losses was far worse than the 524,000 that economists expected. Job reductions in November and December also were deeper than previously reported.

With cost-cutting employers in no mood to hire, the unemployment rate bolted to 7.6 percent in January, the highest since September 1992. The increase in the jobless rate from 7.2 percent in December also was worse than the 7.5 percent rate economists expected.

All told, the economy has lost a staggering 3.6 million jobs since the recession began in December 2007. About half of this decline occurred in the past three months.

"Companies are in survival mode and are really cutting to the bone," said economist Ken Mayland, president of ClearView Economics. "They are cutting and cutting hard now out of fear of an uncertain future."

Factories slashed 207,000 jobs in January, the largest one-month drop since October 1982, partly reflecting heavy losses at plants making autos and related parts. Construction companies got rid of 111,000 jobs. Professional and business services chopped 121,000 positions. Retailers eliminated 45,000 jobs. Leisure and hospitality axed 28,000 slots.

Those reductions swamped employment gains in education and health services, as well as in the government.

Just in the 12 months ending January, an astonishing 3.5 million jobs have vanished, the most on record going back to 1939, although the total number of jobs has grown significantly since then.

Employers are slashing payrolls and turning to other ways to cut costs — including trimming workers' hours, freezing wages or cutting pay — to cope with shrinking appetites from customers in the U.S. and overseas, who are struggling with their own economic troubles.

The average work week in January stayed at 33.3 hours, matching the record low set in December.

With no place to go, the number of unemployed workers climbed to 11.6 million.

Over the past 12 months, the number of unemployed has increased by 4.1 million, and the unemployment rate has risen by 2.7 percentage points.

Job hunters also are facing longer searches for work.

The average time it took for an unemployed person to find any job — full or part time — rose to 19.8 weeks in January, compared with 17.5 weeks a year ago, underscoring the increasing difficulty the out-of-work are having in finding a new job.

Workers with jobs saw modest wage gains.

Average hourly earnings rose to $18.46 in January, up 0.3 percent from the previous month. Over the year, wages have risen 3.9 percent.

An avalanche of layoffs is slamming the nation from a wide swath of employers.

Caterpillar Inc., Pfizer Inc., Microsoft Corp., Estee Lauder Cos., Time Warner Cable Inc., and Sprint Nextel Corp. are among the companies slicing payrolls. Manufacturers — especially car makers — construction companies and retailers have been particularly hard hit by the recession. Talbots Inc., Liz Claiborne Inc., Macy's Inc. and Home Depot Inc. are all cutting jobs. So are Detroit's General Motors Corp. and Ford Motor Co.

Americans cut back sharply on spending at the end of last year, thrusting the economy into its worst backslide in a quarter-century. The tailspin could well accelerate in the current January-March quarter to a rate of 5 percent or more as the recession drags on into a second year, and consumers and businesses burrow deeper.

Vanishing jobs and evaporating wealth from tanking home values, 401(k)s and other investments have forced consumers to retrench, which has required companies to pull back. It's a vicious cycle where the economy's problems feed on each other, perpetuating a downward spiral.

Many economists predict the current quarter — in terms of lost economic growth — will be the worst of the recession.

With fallout from the housing, credit and financial crises — the worst since the 1930s — ripping through the economy, analysts predict 3 million or more jobs will vanish this year even if lawmakers quickly approve Obama's stimulus plan, which has ballooned to more than $900 billion in the Senate.

Obama has repeatedly pressed Congress to swiftly enact a package of increased government spending, including big public works projects and tax cuts, to revive the economy and create jobs. He says his plan will save or create more than 3 million jobs in the next two years.

But the recession has proven stubborn. Despite record low interest rates ordered by the Federal Reserve and a raft of radical programs, including a $700 billion financial bailout, consumers and businesses face high hurdles to borrow money. Foreclosures are skyrocketing, home prices are sinking and Wall Street remains on edge.

Labels:

employment,

jobless claims,

Jobless Rate,

Unemployment Rates

Monday, January 26, 2009

Tens of thousands more layoffs are announced

It's already been a lousy year for workers less than a month into 2009 and there's no relief in sight. Tens of thousands of fresh layoffs were announced Monday and more companies are expected to cut payrolls in the months ahead.

A new survey by the National Association for Business Economics depicts the worst business conditions in the U.S. since the report's inception in 1982.

Thirty-nine percent of NABE's forecasters predicted job reductions through attrition or "significant" layoffs over the next six months, up from 32 percent in the previous survey in October. Around 45 percent in the current survey anticipated no change in hiring plans, while roughly 17 percent thought hiring would increase.

The recession, which started in December 2007, and is expected to stretch into this year, has been a job killer. The economy lost 2.6 million jobs last year, the most since 1945. The unemployment rate jumped to 7.2 percent in December, the highest in 16 years, and is expected to keep climbing.

"Job losses accelerated in the fourth quarter, and the employment outlook for the next six months has weakened further," said Sara Johnson, NABE's lead analyst on the survey and an economist at IHS Global Insight.

Thousands more jobs cuts were announced Monday. Pharmaceutical giant Pfizer Inc., which is buying rival drugmaker Wyeth in a $68 billion deal, and Sprint Nextel Corp., the country's third-largest wireless provider, said they each will slash 8,000 jobs. Home Depot Inc., the biggest home improvement retailer in the U.S., will get rid of 7,000 jobs, and General Motors Corp. said it will cut 2,000 jobs at plants in Michigan and Ohio due to slow sales.

Caterpillar Inc., the world's largest maker of mining and construction equipment, announced 5,000 new layoffs on top of several earlier actions. The latest cuts of support and management employees will be made globally by the end of March. An additional 2,500 workers already have accepted buyout offers, and ties have been severed with about 8,000 contract workers worldwide. In addition, about 4,000 full-time factory workers already have been let go.

Just last week, Microsoft Corp. said it will slash up to 5,000 jobs over the next 18 months. Intel Corp. said it will cut up to 6,000 manufacturing jobs and United Airlines parent UAL Corp. said it would get rid of 1,000 jobs, on top of 1,500 axed late last year.

The NABE survey of 105 forecasters was taken Dec. 17 through Jan. 8.

Also in the survey, 52 percent said they expected gross domestic product to fall by more than 1 percent this year. GDP measures the value of all goods and services produced within the U.S. and is the best barometer of the country's economic fitness. The last time GDP fell for a full year was in 1991, a tiny 0.2 percent dip. The economy shrank by 1.9 percent in 1982, when the country was suffering through a severe recession.

Forecasters have grown more pessimistic about the outlook. In the October survey, no forecaster thought GDP would fall by more than 1 percent.

In terms of business conditions, more reported customer demand dropping, capital spending reductions and shrinking profit margins.

Peoria, Ill.-based Caterpillar also reported Monday that its fourth-quarter profit plunged 32 percent. The company expects sharply lower results this year as global economic problems cut into its business.

Altogether the NABE report "depicts the worst business conditions since the survey began in 1982, confirming that the U.S. recession deepened in the fourth quarter of 2008," Johnson said.

Many analysts predict the economy will have contracted at a pace of 5.4 percent in the fourth quarter when the government releases that report on Friday. If they are correct, that would mark the worst performance since a 6.4 percent drop in the first quarter of 1982. The economy is still contracting now — at a pace of around 4 percent, according to some projections.

Thursday, January 22, 2009

Economic crisis hitting men harder than women

The economic crisis is hitting men much harder than women in the workplace, largely because male-dominated industries like construction and transportation are bearing the brunt of job losses, figures show.

Women, meanwhile, dominate sectors that are still growing, like government and healthcare, experts said.

"It's men that have taken the hit," said Andrew Sum, director of the Center for Labor Market Studies at Northeastern University in Boston. "It's been an overwhelmingly male phenomena."

Four-fifths of the 2.74 million people who lost their jobs between November 2007 and November 2008 were men, Sum said.

The biggest losses came in construction, where men comprise 87 percent of the work force, he said. Large losses also came in manufacturing and wholesale trade, where men make up more than two-thirds of the work force, he said.

"Males were dominant in sectors that were taking a bad hit," he said. "It's men and the blue-collar jobs. It's overwhelming."

According to the U.S. Bureau of Labor Statistics, men's employment as a ratio of the population dropped by 2.7 percent, while the ratio among women's dropped 0.8 percent from December 2007 to December 2008. The unemployment rate among men rose to 7.9 percent from 5.0, while among women, it rose to 6.4 percent from 4.8 percent, the agency said.

The gap between men's and women's unemployment is the highest since 1983, said Heather Boushey, senior economist at the Center for American Progress.

"The recession started with the collapse of the housing bubble," Boushey said. "Clearly we've seen significant layoffs in the construction industry and other sectors, and that really has been driving this problem."

Meanwhile, women are strongly represented in sectors that are still growing, experts noted.

Health and education sectors -- where three-quarters of workers are women -- added 536,000 jobs, Sum said.

Women office workers, like receptionists and clerical workers, have suffered losses. The sector, more than 70 percent female, has lost about 800,000 jobs, Sum said.

Women accounted for 102,000 of the 134,000 lost in the financial sector, Boushey said. But job loss in that industry has been relatively small, compared to manufacturing jobs, she said.

Women may see more job losses ahead in the financial sector, where they hold about 59 percent of jobs, Sum said.

"They're just beginning to lay off," he said. "I expect to see more business-related losses in the months ahead."

Thursday, December 11, 2008

New unemployment claims surge unexpectedly

The Labor Department reported Thursday that initial applications for jobless benefits in the week ending Dec. 6 rose to a seasonally adjusted 573,000 from an upwardly revised figure of 515,000 in the previous week. That was far more than the 525,000 claims Wall Street economists expected.

Elsewhere, the U.S. trade deficit rose unexpectedly in October as a spreading global recession dampened the once-strong sales of American exports and the volume of oil imports surged by a record amount, the Commerce Department said.

More layoffs were announced Thursday. New Britain, Conn.-based tool maker Stanley Works said it plans to cut 2,000 jobs and close three manufacturing facilities, while Sara Lee Corp., known for food brands such as Jimmy Dean and Hillshire Farm, said it will cut 700 jobs as the Downers Grove, Ill.-based company outsources parts of its business.

New jobless claims last week reached their highest level since November 1982, though the labor force has grown by about half since then.

The trade deficit rose to $57.2 billion in October, from an imbalance of $56.6 billion in September. Analysts had been looking for the deficit to decline to $53.5 billion on lower oil prices. Oil prices did drop by a record amount, but that was offset by a record surge in the volume of oil imports.

The reports, along with investor concerns that an auto bailout bill may not pass the Senate, sent stock markets slightly lower. The Dow Jones industrial average fell about 15 points in morning trading.

The jump in initial jobless claims is partly due to a rebound in claims from the previous week, which included the Thanksgiving holiday, a Labor Department analyst said. Government offices were open for fewer days that week.

Still, the four-week average, which smooths out fluctuations, was a seasonally-adjusted 540,500, the highest since December 1982, when the economy was emerging from a steep recession.

"Stepping back from the short-term noise ... it is very clear that the underlying trend in claims is still rocketing, as companies throw in the towel and prepare for a long, deep recession," Ian Shepherdson, chief U.S. economist for High Frequency Economics, wrote in a note to clients.

The number of people continuing to claim jobless benefits also jumped much more than expected, increasing by 338,000 to 4.4 million, the Labor Department said. Economists expected a small increase to 4.1 million. The figure for continuing claims lags initial claims by one week.

As a proportion of the work force, the number of people continuing to receive benefits is the highest since August 1992, when the U.S. was recovering from a relatively mild recession. The increase in continuing claims was the largest jump since November 1974, the department said.

Economists consider jobless claims a timely, if volatile, indicator of the health of the labor markets and broader economy. Last year, initial claims were 337,000.

The figures come a day after the Treasury Department reported a record budget deficit for November, driven by lower tax revenues and higher spending on programs such as unemployment insurance and food stamps.

In just the first two months of the budget year that started Oct. 1, the budget deficit totaled $401.6 billion, nearly matching the record gap of $455 billion posted for all of last year, the department said Wednesday.

Economists expect the deficit will top $1 trillion in the current budget year, which would be a post-World War II high when measured as a percentage of the economy.

The economy has been hit hard by the ongoing housing slump and financial crisis, which have sharply reduced household wealth as stock prices and home values have declined. Consumers and businesses have dramatically cut back their spending. The National Bureau of Economic Research said this month that the economy fell into a recession in December 2007.

The Labor Department said last week that employers cut a net total of 533,000 jobs in November and the unemployment rate reached 6.7 percent, a 15-year high. The rate would have been higher, except that more than 400,000 Americans gave up looking for a new job and weren't counted in the labor force.

The latest jobless claims figures indicate that the December unemployment report could be at least as bad as November's, Abiel Reinhart, an analyst at JPMorgan Chase Bank, wrote in a client note.

Companies have eliminated a net total of 1.9 million jobs this year, and some economists project the total cuts could reach 3 million by the spring of 2010.

A number of large U.S. employers announced layoffs this week, including Dow Chemical Co., 3M Co., Anheuser-Busch InBev, National Public Radio and the National Football League.

Subscribe to:

Posts (Atom)