A new value-added tax (VAT) is "on the table" to help the U.S. address its fiscal liabilities, House Speaker Nancy Pelosi (D-Calif.) said Monday night.

Pelosi, appearing on PBS's "The Charlie Rose Show" asserted that "it's fair to look at" the VAT as part of an overhaul of the nation's tax code.

"I would say, Put everything on the table and subject it to the scrutiny that it deserves," Pelosi told Rose when asked if the VAT has any appeal to her.

The VAT is a tax on manufacturers at each stage of production on the amount of value an additional producer adds to a product.

Pelosi argued that the VAT would level the playing field between U.S. and foreign manufacturers, the latter of which do not have pension and healthcare costs included in the price of their goods because their governments provide those services, financed by similar taxes.

"They get a tax off of that and they use that money to pay the healthcare for their own workers," Pelosi said, using the example of auto manufacturers. "So their cars coming into our country don't have a healthcare component cost.

"Somewhere along the way, a value-added tax plays into this. Of course, we want to take down the healthcare cost, that's one part of it," the Speaker added. "But in the scheme of things, I think it's fair look at a value- added tax as well."

Pelosi said that any new taxes would come after the Congress finishes the healthcare debate consuming most lawmakers' time, and that it may come as part of a larger overhaul to the tax code.

The Speaker also emphasized that any reworking of the tax code would not result in an increase in taxes on middle-class Americans.

Showing posts with label finance. Show all posts

Showing posts with label finance. Show all posts

Tuesday, October 6, 2009

Monday, April 20, 2009

Bank of America posts profit, surprises investors

Waking up this morning to find Bank of America posted a profit on their stock was great.

I've own Bank of America stock since Oct. 2007 and while I will say that purchasing it at $35.50 still have me at a loss, I hope the stock rises.

Depending on what the stock do today and in a few days, I might double on on my holding to bring my cost basis down.

Bank of America managed to avoid a loss in the first quarter, surpassing analysts' expectations and providing further evidence the banking sector might be improving.

The company says it earned $2.81 billion after paying preferred dividends, or 44 cents per share. Analysts expected profit of 4 cents per share.

However, Bank of America recorded a $13.4 billion loan-loss provision, proving that it is not immune from deteriorating credit quality and growing unemployment.

With better-than-expected profit is the latest in a string of bank earnings that have beat expectations, including JPMorgan Chase and Citigroup.

Bank of America has received $45 billion in government funds as part of the Treasury Department's $700 billion financial rescue package.

I've own Bank of America stock since Oct. 2007 and while I will say that purchasing it at $35.50 still have me at a loss, I hope the stock rises.

Depending on what the stock do today and in a few days, I might double on on my holding to bring my cost basis down.

Bank of America managed to avoid a loss in the first quarter, surpassing analysts' expectations and providing further evidence the banking sector might be improving.

The company says it earned $2.81 billion after paying preferred dividends, or 44 cents per share. Analysts expected profit of 4 cents per share.

However, Bank of America recorded a $13.4 billion loan-loss provision, proving that it is not immune from deteriorating credit quality and growing unemployment.

With better-than-expected profit is the latest in a string of bank earnings that have beat expectations, including JPMorgan Chase and Citigroup.

Bank of America has received $45 billion in government funds as part of the Treasury Department's $700 billion financial rescue package.

Monday, April 6, 2009

Get Free Cash for College

It sounds like just a new twist on the all-too common Nigerian scams or Madoff-style Wall Street bait-and-switch. But it's true: Some states, businesses, and colleges are really handing out free cash to help build up parents' college savings accounts.

There are a few catches, of course. Nobody should sign up for anything that sounds suspiciously good without doing a little homework. And most of the grants and rebates are comparatively modest: The typical family might reap a few hundred dollars. Few parents will get enough free cash to make up for the average 20-plus percent decline in 529 college savings plans over the past year. (Tax-protected education savings accounts are called 529s after the part of the Internal Revenue Service code that created them.)

Still, those who collect the grants when their children are young or who are diligent about maximizing rebates could generate several extra thousand dollars.

No wonder those handing out the grants say interest is booming. More than half a million people have signed up for at least one of the rebate or grant programs since the beginning of the year. "You may as well get free money," says Joseph Hurley, founder of savingforcollege.com, who says his credit card and shopping rebates have added thousands of dollars to his family's 529.

There are six sources of free cash for college savings:

States: In at least nine states, government agencies or charities offer grants for college savings to local residents. Maine, for example, in 2009 started handing out $500 to babies born in the state for whom an adult opens a Maine 529. In states such as Arkansas, Colorado, Michigan, Minnesota, Rhode Island, and Utah, the matching grants go only to low- and middle-income families. Louisiana, New Jersey, and a few other states offer different kinds of grants or scholarship programs to encourage savers.

The catches: Each state has its own deadlines and red tape. Some require parents to fill out long forms early each year, for example. Utah's grants are so new and limited that only 19 families had qualified in the first three months of the program, which started January 1. And the Utah Educational Savings Plan, which awards the money, will stop accepting applications for the year on May 29.

Employers: In 2008, Unum started giving new parents grants of $700. The catches: Parents have to open a 529 savings account before the baby's first birthday, and the bonus is taxable.

Credit cards: Fidelity offers an American Express card that will rebate 2 percent of all purchases to a Fidelity 529. Upromise just launched a Mastercard that will send rebate checks or funnel rebates to a Upromise 529 account or to reduce Sallie Mae educational loans. The new card will rebate at least 1 percent on all purchases, 10 percent on groceries at selected stores, and--if consumers choose--additional rebates on certain gasoline or restaurant purchases. Babymint, Futuretrust, and FreshmanFund offer credit cards that rebate at least 1 percent to any 529 account. The catches: Spenders who carry balances or pay bills late will most likely pay more in interest and fees than they will save for college. Travis Plunkett, spokesman for the Consumer Federation of America, notes that credit card companies are not charities; accordingly, they are probably making more money from their borrowers than they are giving back.

Websites: Babymint, Littlegrad, Futuretrust, Upromise, and other rebate websites will send cash back to shoppers who click through their sites to partner retailers. The catches: Some of the websites make you jump through a few hoops to collect your cash.

Colleges: Several hundred colleges are offering matching grants for parents who sock away college savings. A marketing company, Sage Scholars Inc., has persuaded 230 private colleges to guarantee "Tuition Rewards" scholarships to students from families who invest or shop with Sage's business partners. And 274 private college members of the prepaid Independent 529 plan give parents at least a half-percentage-point discount if they buy tuition for a youngster at today's cost. Dickinson College upped the discount ante last year, adding an extra 4 percent to its inflation discount. That means a family with a 10-year-old who puts about $29,000 in the plan today will have paid a year's tuition in 2017, even though a year's tuition in 2009 is nearly $40,000 and, at the current rate of inflation, will probably reach $60,000 in eight years.

The catches: Plenty. Both the Independent 529 and Sage Scholars networks of colleges are limited to a few hundred comparatively expensive private colleges. There's no guarantee members' children will apply to or be admitted to the member schools. Both programs require parents to sign up several years before they tap their money. And both cover only tuition, not room, board, books, or any other college-related expenses. Sage members build up Tuition Rewards only by investing or shopping with Sage partners, some of whom charge more for their products and services than competitors not affiliated with the firm. In addition, parents of students who don't attend a member school don't get a penny of the promised scholarships back. Sage rules allow colleges to count "rewards," which average about $1,700 a year, against scholarships they were going to give the student anyway, so students may not really get any extra money. If a student doesn't end up attending a member of the Independent 529 network, parents who withdraw their money can receive no more than 2 percent more than they contributed. (But they are also limited to 2 percent less than they contributed, which makes the prepaid plan comparatively attractive right now, when the stock market is weak.)

Relatives and friends: Freshmanfund.com and Ugift offer electronic tools to make it easier to ask relatives and friends to donate to your college savings account in lieu of, say, a birthday or graduation gift. The catches: While Freshmanfund will funnel gifts to any 529, Ugift will work only with Upromise 529s. Some relatives and friends might find requests for donations to be, well, tacky. And, let's face it, you might not have many wealthy relatives. Ugift says that half of the birthday or other event donation requests result in total donations of no more than $100.

There are a few catches, of course. Nobody should sign up for anything that sounds suspiciously good without doing a little homework. And most of the grants and rebates are comparatively modest: The typical family might reap a few hundred dollars. Few parents will get enough free cash to make up for the average 20-plus percent decline in 529 college savings plans over the past year. (Tax-protected education savings accounts are called 529s after the part of the Internal Revenue Service code that created them.)

Still, those who collect the grants when their children are young or who are diligent about maximizing rebates could generate several extra thousand dollars.

No wonder those handing out the grants say interest is booming. More than half a million people have signed up for at least one of the rebate or grant programs since the beginning of the year. "You may as well get free money," says Joseph Hurley, founder of savingforcollege.com, who says his credit card and shopping rebates have added thousands of dollars to his family's 529.

There are six sources of free cash for college savings:

States: In at least nine states, government agencies or charities offer grants for college savings to local residents. Maine, for example, in 2009 started handing out $500 to babies born in the state for whom an adult opens a Maine 529. In states such as Arkansas, Colorado, Michigan, Minnesota, Rhode Island, and Utah, the matching grants go only to low- and middle-income families. Louisiana, New Jersey, and a few other states offer different kinds of grants or scholarship programs to encourage savers.

The catches: Each state has its own deadlines and red tape. Some require parents to fill out long forms early each year, for example. Utah's grants are so new and limited that only 19 families had qualified in the first three months of the program, which started January 1. And the Utah Educational Savings Plan, which awards the money, will stop accepting applications for the year on May 29.

Employers: In 2008, Unum started giving new parents grants of $700. The catches: Parents have to open a 529 savings account before the baby's first birthday, and the bonus is taxable.

Credit cards: Fidelity offers an American Express card that will rebate 2 percent of all purchases to a Fidelity 529. Upromise just launched a Mastercard that will send rebate checks or funnel rebates to a Upromise 529 account or to reduce Sallie Mae educational loans. The new card will rebate at least 1 percent on all purchases, 10 percent on groceries at selected stores, and--if consumers choose--additional rebates on certain gasoline or restaurant purchases. Babymint, Futuretrust, and FreshmanFund offer credit cards that rebate at least 1 percent to any 529 account. The catches: Spenders who carry balances or pay bills late will most likely pay more in interest and fees than they will save for college. Travis Plunkett, spokesman for the Consumer Federation of America, notes that credit card companies are not charities; accordingly, they are probably making more money from their borrowers than they are giving back.

Websites: Babymint, Littlegrad, Futuretrust, Upromise, and other rebate websites will send cash back to shoppers who click through their sites to partner retailers. The catches: Some of the websites make you jump through a few hoops to collect your cash.

Colleges: Several hundred colleges are offering matching grants for parents who sock away college savings. A marketing company, Sage Scholars Inc., has persuaded 230 private colleges to guarantee "Tuition Rewards" scholarships to students from families who invest or shop with Sage's business partners. And 274 private college members of the prepaid Independent 529 plan give parents at least a half-percentage-point discount if they buy tuition for a youngster at today's cost. Dickinson College upped the discount ante last year, adding an extra 4 percent to its inflation discount. That means a family with a 10-year-old who puts about $29,000 in the plan today will have paid a year's tuition in 2017, even though a year's tuition in 2009 is nearly $40,000 and, at the current rate of inflation, will probably reach $60,000 in eight years.

The catches: Plenty. Both the Independent 529 and Sage Scholars networks of colleges are limited to a few hundred comparatively expensive private colleges. There's no guarantee members' children will apply to or be admitted to the member schools. Both programs require parents to sign up several years before they tap their money. And both cover only tuition, not room, board, books, or any other college-related expenses. Sage members build up Tuition Rewards only by investing or shopping with Sage partners, some of whom charge more for their products and services than competitors not affiliated with the firm. In addition, parents of students who don't attend a member school don't get a penny of the promised scholarships back. Sage rules allow colleges to count "rewards," which average about $1,700 a year, against scholarships they were going to give the student anyway, so students may not really get any extra money. If a student doesn't end up attending a member of the Independent 529 network, parents who withdraw their money can receive no more than 2 percent more than they contributed. (But they are also limited to 2 percent less than they contributed, which makes the prepaid plan comparatively attractive right now, when the stock market is weak.)

Relatives and friends: Freshmanfund.com and Ugift offer electronic tools to make it easier to ask relatives and friends to donate to your college savings account in lieu of, say, a birthday or graduation gift. The catches: While Freshmanfund will funnel gifts to any 529, Ugift will work only with Upromise 529s. Some relatives and friends might find requests for donations to be, well, tacky. And, let's face it, you might not have many wealthy relatives. Ugift says that half of the birthday or other event donation requests result in total donations of no more than $100.

Wednesday, March 4, 2009

Obama administration launches housing plan

The Obama administration kicked off a new program Wednesday that's designed to help up to 9 million borrowers stay in their homes through refinanced mortgages or loans that are modified to lower monthly payments.

Borrowers, however, are being advised to be patient in their efforts to get help because mortgage companies are likely to be flooded with calls.

Government officials, launching the "Making Home Affordable" program also acknowledge that the initiatives are only a partial fix for a sweeping problem that has helped plunge the U.S. economy into the worst recession in decades. In fact, tens of thousands of homeowners in some of the most battered real estate markets — concentrated in California, Florida, Nevada and Arizona — won't be eligible for the two programs.

"It's not intended to prevent every foreclosure or to help every homeowner," a senior Treasury Department official told reporters. "It's really targeted at responsible homeowners."

There was also skepticism that banks would be willing to participate.

"I've just seen so many of the programs not work," said Pava Leyrer, president of Heritage National Mortgage in Randville, Mich. "It gets borrowers hopes up. They call and call for these programs and we can't get anybody to do them."

The Obama administration's program has two parts: one to work with lenders to modify the loan terms for up to 4 million homeowner, the second to refinance up to 5 million homeowners into more affordable fixed-rate loans.

For the modification program, borrowers who are eligible will have to provide their most recent tax return and two pay stubs, as well as an "affidavit of financial hardship" to qualify for the loan modification program, which runs through 2012.

Borrowers are only allowed to have their loans modified once, and the program only applies for loans made on Jan. 1 2009, or earlier. Mortgages for single-family properties that are worth more than $729,750 are excluded.

Lenders could reduce a borrower's interest rate to as low as 2 percent for five years. Rates would then rise to about 5 percent until the mortgage is repaid.

If the plan works as intended, it could be a big plus for borrowers like Nick Kavalary, a network cable installer who lives outside Milwaukee.

Kavalary, 42, has been struggling with JPMorgan Chase & Co. to get a loan modification. He was finally approved for one this year, but it only cuts his interest rate to about 9.8 percent from 10.75 percent. Even at the lower rate, he said, making the payment is nearly impossible.

"If I can't pick up a second job, I'm going to lose this house," he said. "With the job market being the way it is, nobody's hiring nobody."

For the refinance program, only homeowners whose loans are held by Fannie Mae or Freddie Mac are eligible and have until June 2010 to apply.

Consumers should contact their loan servicer — the company that sends out their monthly bill — to find out if their mortgages are held by Fannie or Freddie. The two mortgage finance companies own or guarantee almost 31 million home loans — more than half of all U.S home mortgages.

Many mortgage brokers, however, are critical. They argue the fees imposed by Fannie and Freddie over the past year make it difficult for borrowers to afford to refinance. The two companies, which are now government controlled, have yet to detail how they will implement the plan, or whether any fees will be rolled back.

Meanwhile, action to put in place another part of Obama's housing plan is expected soon on Capitol Hill.

House Democrats agreed Tuesday to narrow proposed legislation that gives bankruptcy judges the power to change the terms of mortgage loans for debt-strapped borrowers.

In the latest version of the bill, judges would have to consider whether a homeowner had been offered a reasonable deal by the bank to rework his or her home loan before seeking help in bankruptcy court. Borrowers also would have a responsibility to prove that they tried to modify their mortgages.

Borrowers, however, are being advised to be patient in their efforts to get help because mortgage companies are likely to be flooded with calls.

Government officials, launching the "Making Home Affordable" program also acknowledge that the initiatives are only a partial fix for a sweeping problem that has helped plunge the U.S. economy into the worst recession in decades. In fact, tens of thousands of homeowners in some of the most battered real estate markets — concentrated in California, Florida, Nevada and Arizona — won't be eligible for the two programs.

"It's not intended to prevent every foreclosure or to help every homeowner," a senior Treasury Department official told reporters. "It's really targeted at responsible homeowners."

There was also skepticism that banks would be willing to participate.

"I've just seen so many of the programs not work," said Pava Leyrer, president of Heritage National Mortgage in Randville, Mich. "It gets borrowers hopes up. They call and call for these programs and we can't get anybody to do them."

The Obama administration's program has two parts: one to work with lenders to modify the loan terms for up to 4 million homeowner, the second to refinance up to 5 million homeowners into more affordable fixed-rate loans.

For the modification program, borrowers who are eligible will have to provide their most recent tax return and two pay stubs, as well as an "affidavit of financial hardship" to qualify for the loan modification program, which runs through 2012.

Borrowers are only allowed to have their loans modified once, and the program only applies for loans made on Jan. 1 2009, or earlier. Mortgages for single-family properties that are worth more than $729,750 are excluded.

Lenders could reduce a borrower's interest rate to as low as 2 percent for five years. Rates would then rise to about 5 percent until the mortgage is repaid.

If the plan works as intended, it could be a big plus for borrowers like Nick Kavalary, a network cable installer who lives outside Milwaukee.

Kavalary, 42, has been struggling with JPMorgan Chase & Co. to get a loan modification. He was finally approved for one this year, but it only cuts his interest rate to about 9.8 percent from 10.75 percent. Even at the lower rate, he said, making the payment is nearly impossible.

"If I can't pick up a second job, I'm going to lose this house," he said. "With the job market being the way it is, nobody's hiring nobody."

For the refinance program, only homeowners whose loans are held by Fannie Mae or Freddie Mac are eligible and have until June 2010 to apply.

Consumers should contact their loan servicer — the company that sends out their monthly bill — to find out if their mortgages are held by Fannie or Freddie. The two mortgage finance companies own or guarantee almost 31 million home loans — more than half of all U.S home mortgages.

Many mortgage brokers, however, are critical. They argue the fees imposed by Fannie and Freddie over the past year make it difficult for borrowers to afford to refinance. The two companies, which are now government controlled, have yet to detail how they will implement the plan, or whether any fees will be rolled back.

Meanwhile, action to put in place another part of Obama's housing plan is expected soon on Capitol Hill.

House Democrats agreed Tuesday to narrow proposed legislation that gives bankruptcy judges the power to change the terms of mortgage loans for debt-strapped borrowers.

In the latest version of the bill, judges would have to consider whether a homeowner had been offered a reasonable deal by the bank to rework his or her home loan before seeking help in bankruptcy court. Borrowers also would have a responsibility to prove that they tried to modify their mortgages.

Thursday, February 5, 2009

Madoff client list peppered with big names

Hall of Fame baseball pitcher Sandy Koufax, actor John Malkovich and World Trade Center developer Larry Silverstein are among the well-known people who were customers of accused swindler Bernard Madoff, according to new court papers.

Among the thousands of others on the roster are U.S. Sen. Frank Lautenberg of New Jersey; Fred Wilpon, owner of the New York Mets baseball team; imprisoned class-action lawyer Melvyn Weiss; Madoff's sons, Mark and Andrew and their children as well as Madoff's brother, Peter.

Filmmaker Steven Spielberg's Wunderkinder Foundation, Columbia University and the charity Jewish Funds for Justice are among other customers listed.

The 162-page document was filed late Wednesday with the U.S. Bankruptcy Court in New York as a court-appointed trustee liquidates Bernard L. Madoff Investment Securities LLC to recover assets for defrauded customers.

In all, five lists were filed with the court, labeled Customers, Vendors, Employees, Brokers/Dealers and Other Parties.

The customer list contains names and addresses of individuals and institutions. No details were included on the amounts of money invested. The lists were put together by AlixPartners LLP, a firm specializing in bankruptcy claims support that is assisting the trustee.

One of Madoff's lawyers, Ira Lee Sorkin, is also named on the customer list.

Sorkin declined to comment to Reuters on Thursday on whether he had invested with Madoff.

"I've been told it's a client list, and I've also been told it's a mailing list, so I think you need to check with the receiver or the trustee to determine whether these individuals are clients, customers, investors or just simply received mail," Sorkin said.

"My position from day one has been I will not discuss present clients or former clients," he said.

The Securities Investor Protection Corporation (SIPC), which is examining Madoff customer claims, was not immediately available for comment. A representative of the trustee, Irving Picard, could not be reached immediately.

The list provides new details about the clients that the once-respected Madoff cultivated over the years -- a roster sprinkled with names of people who live in affluent neighborhoods of Manhattan and parts of South Florida including Palm Beach and Boca Raton. Madoff long attracted clients through his reputation for posting amazingly consistent investment returns.

The Manhattan office of Madoff's firm was declared a crime scene after the 70-year-old investment manager was arrested on Dec. 11. Madoff is accused in what authorities have described as the biggest Ponzi scheme in history. In a Ponzi scheme, early investors are paid with money from new investors.

Also listed are the Madoff firm's outside auditors, David Friehling and Jerome Horowitz from the small Friehling & Horowitz accounting firm in New City, New York, as well as Madoff's wife, Ruth, and Madoff employees, including JoAnne "Jodi" Crupi and Frank DiPascali.

Among the financial institutions on the customer list are UBS AG, Bank of America Corp, BNP Paribas and Citigroup Inc.

Financiere Agache, a subsidiary of the holding company of French billionaire Bernard Arnault, was also on the list. Arnault is the head of luxury goods group LVMH and his Groupe Arnault holding firm controls Financiere Agache.

A spokesman for Financiere Agache told Reuters its account with Madoff had been inactive since 2004, although it had not been legally closed. The spokesman added that Financiere Agache had not booked any losses from the account.

At a bankruptcy court hearing on Wednesday, Picard said $946 million has been recovered so far from Madoff's firm. He said, however, that gaining access to the firm's computers and examining 7,000 unmarked boxes of documents stored in a warehouse was taking time.

Among the thousands of others on the roster are U.S. Sen. Frank Lautenberg of New Jersey; Fred Wilpon, owner of the New York Mets baseball team; imprisoned class-action lawyer Melvyn Weiss; Madoff's sons, Mark and Andrew and their children as well as Madoff's brother, Peter.

Filmmaker Steven Spielberg's Wunderkinder Foundation, Columbia University and the charity Jewish Funds for Justice are among other customers listed.

The 162-page document was filed late Wednesday with the U.S. Bankruptcy Court in New York as a court-appointed trustee liquidates Bernard L. Madoff Investment Securities LLC to recover assets for defrauded customers.

In all, five lists were filed with the court, labeled Customers, Vendors, Employees, Brokers/Dealers and Other Parties.

The customer list contains names and addresses of individuals and institutions. No details were included on the amounts of money invested. The lists were put together by AlixPartners LLP, a firm specializing in bankruptcy claims support that is assisting the trustee.

One of Madoff's lawyers, Ira Lee Sorkin, is also named on the customer list.

Sorkin declined to comment to Reuters on Thursday on whether he had invested with Madoff.

"I've been told it's a client list, and I've also been told it's a mailing list, so I think you need to check with the receiver or the trustee to determine whether these individuals are clients, customers, investors or just simply received mail," Sorkin said.

"My position from day one has been I will not discuss present clients or former clients," he said.

The Securities Investor Protection Corporation (SIPC), which is examining Madoff customer claims, was not immediately available for comment. A representative of the trustee, Irving Picard, could not be reached immediately.

The list provides new details about the clients that the once-respected Madoff cultivated over the years -- a roster sprinkled with names of people who live in affluent neighborhoods of Manhattan and parts of South Florida including Palm Beach and Boca Raton. Madoff long attracted clients through his reputation for posting amazingly consistent investment returns.

The Manhattan office of Madoff's firm was declared a crime scene after the 70-year-old investment manager was arrested on Dec. 11. Madoff is accused in what authorities have described as the biggest Ponzi scheme in history. In a Ponzi scheme, early investors are paid with money from new investors.

Also listed are the Madoff firm's outside auditors, David Friehling and Jerome Horowitz from the small Friehling & Horowitz accounting firm in New City, New York, as well as Madoff's wife, Ruth, and Madoff employees, including JoAnne "Jodi" Crupi and Frank DiPascali.

Among the financial institutions on the customer list are UBS AG, Bank of America Corp, BNP Paribas and Citigroup Inc.

Financiere Agache, a subsidiary of the holding company of French billionaire Bernard Arnault, was also on the list. Arnault is the head of luxury goods group LVMH and his Groupe Arnault holding firm controls Financiere Agache.

A spokesman for Financiere Agache told Reuters its account with Madoff had been inactive since 2004, although it had not been legally closed. The spokesman added that Financiere Agache had not booked any losses from the account.

At a bankruptcy court hearing on Wednesday, Picard said $946 million has been recovered so far from Madoff's firm. He said, however, that gaining access to the firm's computers and examining 7,000 unmarked boxes of documents stored in a warehouse was taking time.

Labels:

bernard madoff,

bernie madoff,

finance,

madoff,

Madoff client list

Thursday, January 22, 2009

Economic crisis hitting men harder than women

The economic crisis is hitting men much harder than women in the workplace, largely because male-dominated industries like construction and transportation are bearing the brunt of job losses, figures show.

Women, meanwhile, dominate sectors that are still growing, like government and healthcare, experts said.

"It's men that have taken the hit," said Andrew Sum, director of the Center for Labor Market Studies at Northeastern University in Boston. "It's been an overwhelmingly male phenomena."

Four-fifths of the 2.74 million people who lost their jobs between November 2007 and November 2008 were men, Sum said.

The biggest losses came in construction, where men comprise 87 percent of the work force, he said. Large losses also came in manufacturing and wholesale trade, where men make up more than two-thirds of the work force, he said.

"Males were dominant in sectors that were taking a bad hit," he said. "It's men and the blue-collar jobs. It's overwhelming."

According to the U.S. Bureau of Labor Statistics, men's employment as a ratio of the population dropped by 2.7 percent, while the ratio among women's dropped 0.8 percent from December 2007 to December 2008. The unemployment rate among men rose to 7.9 percent from 5.0, while among women, it rose to 6.4 percent from 4.8 percent, the agency said.

The gap between men's and women's unemployment is the highest since 1983, said Heather Boushey, senior economist at the Center for American Progress.

"The recession started with the collapse of the housing bubble," Boushey said. "Clearly we've seen significant layoffs in the construction industry and other sectors, and that really has been driving this problem."

Meanwhile, women are strongly represented in sectors that are still growing, experts noted.

Health and education sectors -- where three-quarters of workers are women -- added 536,000 jobs, Sum said.

Women office workers, like receptionists and clerical workers, have suffered losses. The sector, more than 70 percent female, has lost about 800,000 jobs, Sum said.

Women accounted for 102,000 of the 134,000 lost in the financial sector, Boushey said. But job loss in that industry has been relatively small, compared to manufacturing jobs, she said.

Women may see more job losses ahead in the financial sector, where they hold about 59 percent of jobs, Sum said.

"They're just beginning to lay off," he said. "I expect to see more business-related losses in the months ahead."

Tuesday, January 20, 2009

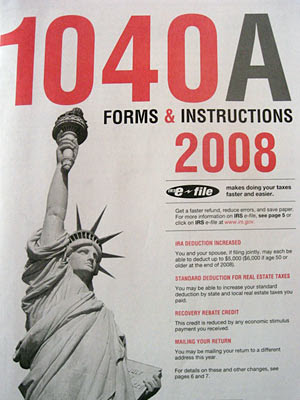

10 New Tax Laws You Need to Know

With each new year comes a new batch of tax rules and miscellaneous changes to the laws that taxpayers need to be aware of. There's no denying that the tax code in the United States is incredibly complex, and there are tons of changes.

Recovery Rebate Credit

If you weren't eligible for an economic stimulus payment in 2008, you might still be able to get that money. The initial payments were based on your 2007 income, and if your income was too low or too high, you may have missed out. You can now use your 2008 income to collect, and the IRS is offering help in calculating whether you qualify.

AMT Exemption Increased

The Alternative Minimum Tax (AMT) is a law that was created to make sure high income earners didn't get out of paying income taxes. Now this rule is affecting more middle-income taxpayers, but the "bailout bill" upped the exemption amount for 2008 to spare more taxpayers from the AMT for one more year.

First Time Homebuyer Credit

If you bought your first home between April 9, 2008 and June 30, 2009, you might qualify for a new credit. Taxpayers can get up to $7,500 from the federal government, which has to be paid back over 15 years at a rate of $500 per year. It amounts to an interest-free loan from Uncle Sam that can help you get your first house.

Tax Relief for Midwest Disaster Areas

If you lived in certain Midwest states that were affected by severe storms, tornadoes or flooding that happened between May 19 and August 1, 2008, you can receive special tax breaks. The rules include reduced restrictions on casualty loss deductions and charitable contribution deductions. There is also an exemption available if you provided housing to a victim of these disasters.

Increased Contribution Limits for IRAs

The tax rules permit taxpayers to contribute to traditional IRAs and Roth IRAs if their income falls within certain parameters. If your income is too high, you are limited in these contributions. All of the limits increased for 2008, which means taxpayers with higher income might still be able to contribute.

Standard Mileage Rate Changed

The standard mileage rate for business use of your vehicle was 50.5 cents per mile for the first six months of 2008, and 58.5 cents per mile for the rest of the year. The rates also changed for miles driven for medical reasons or charitable purposes.

Capital Gains Taxes Lowered

Those with lower incomes will benefit from a reduction in the lowest capital gains rate. The formerly 5% rate for married taxpayers with income under $65,100 and single taxpayers with income under $32,500 has now been reduced to 0%.

Kiddie Tax Changes

The rules related to investment income of children have changed to include students between ages 18 and 24 who are not financially reporting themselves. A child with investment income greater than $1,800 must be taxed at the parent's tax rate to avoid shifting of investments to children to escape income taxes.

Required Minimum Distributions From IRAs

Retirees with tax-deferred retirement funds such as 401(k)s and IRAs are required to take minimum amounts out of those funds once they reach age 70 ½ . The government requires this because those amounts taken out are taxable on withdrawal, and it ensures the IRS gets something from retirees. Because of the stock market troubles, RMDs are suspended for 2009. That doesn't help when preparing 2008 taxes, but is important to note for planning for 2009.

Free Tax Help

Low income and elderly taxpayers have several options for free tax help. The most extensive option is the Volunteer Income Tax Assistance program. Qualified tax preparers volunteer their time to help answer tax questions and prepare basic tax returns. Taxpayers can also get assistance by calling the IRS or visiting one of their walk-in centers.

Labels:

2008 taxes,

finance,

money and finance,

new tax laws,

tax questions

Thursday, January 15, 2009

Seven Surprising Stay-Home Salaries

Sales Representatives

More than ever, big companies are farming out their sales forces. But instead of jobs going overseas, they're going to the suburbs. According to the BLS, one in five sales reps telecommute. The highest paying sales jobs usually involve technical and scientific products. These sales jobs are more likely to require a bachelor's degree. Studying marketing, business, or communications can be excellent preparation for this line of work.

Stay-Home Salary: $68,270

Financial Analysts

Financial analysts help large companies and non-profit organizations figure out how, when, and where to invest their money. Often employed by investment banks, mutual funds, and insurance companies, the independent nature of the work lends itself to working from the home office. You'll need a bachelor's degree in finance, business administration, economics, or accounting to get in on the ground floor.

Stay-Home Salary: $70,400

Personal Financial Advisors

This is another high finance, home-office profession. Instead of working with large endowments, personal financial advisors help individuals manage their money, protect their assets, and plan for retirement. Financial advisors work for financial services firms or investment and planning firms. A minimum of a bachelor's degree in finance, business administration, or accounting is required.

Stay-Home Salary: $67,660

Web Designers

Two career paths that are particularly well suited to telecommuting are graphic design and computing. These career paths intersect for the job of Web developers, also called Web designers. These creative techies craft a Web site's look and make sure it functions. Most employers are looking for a bachelor's degree, and many schools offer programs specifically in Web site design.

Stay-Home Salary: $47,000 to $71,500

Software Developers

These tech-savvy telecommuters design and develop commuter applications. Therefore, they need to be well versed in programming languages as well as operating systems. A bachelor's degree in computer science or software engineering is required, but your education is likely to pay off. The BLS predicts 38 percent growth through 2016, making this one of the nation's fastest growing occupations.

Stay-Home Salary: $83,130

Accountant

Accounting is all about keeping the fiscal house in order--paying taxes, reporting earnings, analyzing budgets, and guiding investments. The individual nature of the work allows many accountants to routinely work from home. Certification and a degree in accounting are typical job requirements.

Stay-Home Salary: $57,060

Marketing Manager

Managers (in any department) are more likely to regularly work from home. Marketing managers may find creativity blooms with the freedom of the home office. Increasingly, a master's degree in business administration is becoming the norm for marketing managers, though a good track record and a bachelor's degree may suffice.

Stay-Home Salary: $104,400

The Truth Behind the Telecommute

Technically, to be considered a telecommuter you must regularly works eight or more paid hours at home each week. Telecommuting can cut down on a killer commute or carve out more time for the kids. It can help you find a better work-life balance. But let's be clear--there are a few things telecommuting is not designed for.

1. It is not a substitute for child care. Imagine trying to hold a conference call while entertaining your two-year-old.

2. It is not for the recluse. The key to successful telecommuting is communication, particularly with your supervisors.

3. It is not entry-level workers. According to the BLS Occupational Outlook Quarterly, it is far more effective for employees to make a case for telecommuting after proving their value.

Working at home can help you save on skyrocketing gas prices, but it makes financial sense for your employer, too. A study done for the Federal Reserve Bank of Dallas showed telecommuters earning $44,000 a year saved their company an average of $10,000. And, telecommuting options improve morale, productivity, and worker retention.

More than ever, big companies are farming out their sales forces. But instead of jobs going overseas, they're going to the suburbs. According to the BLS, one in five sales reps telecommute. The highest paying sales jobs usually involve technical and scientific products. These sales jobs are more likely to require a bachelor's degree. Studying marketing, business, or communications can be excellent preparation for this line of work.

Stay-Home Salary: $68,270

Financial Analysts

Financial analysts help large companies and non-profit organizations figure out how, when, and where to invest their money. Often employed by investment banks, mutual funds, and insurance companies, the independent nature of the work lends itself to working from the home office. You'll need a bachelor's degree in finance, business administration, economics, or accounting to get in on the ground floor.

Stay-Home Salary: $70,400

Personal Financial Advisors

This is another high finance, home-office profession. Instead of working with large endowments, personal financial advisors help individuals manage their money, protect their assets, and plan for retirement. Financial advisors work for financial services firms or investment and planning firms. A minimum of a bachelor's degree in finance, business administration, or accounting is required.

Stay-Home Salary: $67,660

Web Designers

Two career paths that are particularly well suited to telecommuting are graphic design and computing. These career paths intersect for the job of Web developers, also called Web designers. These creative techies craft a Web site's look and make sure it functions. Most employers are looking for a bachelor's degree, and many schools offer programs specifically in Web site design.

Stay-Home Salary: $47,000 to $71,500

Software Developers

These tech-savvy telecommuters design and develop commuter applications. Therefore, they need to be well versed in programming languages as well as operating systems. A bachelor's degree in computer science or software engineering is required, but your education is likely to pay off. The BLS predicts 38 percent growth through 2016, making this one of the nation's fastest growing occupations.

Stay-Home Salary: $83,130

Accountant

Accounting is all about keeping the fiscal house in order--paying taxes, reporting earnings, analyzing budgets, and guiding investments. The individual nature of the work allows many accountants to routinely work from home. Certification and a degree in accounting are typical job requirements.

Stay-Home Salary: $57,060

Marketing Manager

Managers (in any department) are more likely to regularly work from home. Marketing managers may find creativity blooms with the freedom of the home office. Increasingly, a master's degree in business administration is becoming the norm for marketing managers, though a good track record and a bachelor's degree may suffice.

Stay-Home Salary: $104,400

The Truth Behind the Telecommute

Technically, to be considered a telecommuter you must regularly works eight or more paid hours at home each week. Telecommuting can cut down on a killer commute or carve out more time for the kids. It can help you find a better work-life balance. But let's be clear--there are a few things telecommuting is not designed for.

1. It is not a substitute for child care. Imagine trying to hold a conference call while entertaining your two-year-old.

2. It is not for the recluse. The key to successful telecommuting is communication, particularly with your supervisors.

3. It is not entry-level workers. According to the BLS Occupational Outlook Quarterly, it is far more effective for employees to make a case for telecommuting after proving their value.

Working at home can help you save on skyrocketing gas prices, but it makes financial sense for your employer, too. A study done for the Federal Reserve Bank of Dallas showed telecommuters earning $44,000 a year saved their company an average of $10,000. And, telecommuting options improve morale, productivity, and worker retention.

Monday, January 12, 2009

Buying on Web to avoid sales taxes could end soon

Shopping online can be a way to find bargains while steering clear of crowds — and sales taxes.

But those tax breaks are starting to erode. With the recession pummeling states' budgets, their governments increasingly want to fill the gaps by collecting taxes on Internet sales, which are growing even as the economy shudders.

And that is sparking conflict with companies that do business online only and have enjoyed being able to offer sales-tax free shopping.

One of the most aggressive states, New York, is being sued by Amazon.com Inc. over a new requirement that online companies must collect taxes on shipments to New York residents, even if the companies are located elsewhere. New York's governor also wants to tax "Taxman" covers and other songs downloaded from Internet services like iTunes.

The amount of money at stake nationwide is unclear; online sales were expected to make up about 8 percent of all retail sales in 2008 and total $204 billion, according to Forrester Research. This is up from $175 billion in 2007.

Based on that 2008 figure, Forrester analyst Sucharita Mulpuru says her rough estimate is that if Web retailers had to collect taxes on all sales to consumers, it could generate $3 billion in new revenue for governments.

It's uncertain how much more could come as well from unpaid sales taxes on Internet transactions between businesses. But even with both kinds of taxes available, state budgets would need more help. The Center on Budget and Policy Priorities estimates that the states' budget gaps in the current fiscal year will total $89 billion.

Collecting online sales taxes is not as simple as it might sound. A nationwide Internet business faces thousands of tax-collecting jurisdictions — states, counties and cities — and tangled rules about how various products are taxed.

And a 1992 U.S. Supreme Court ruling said that states can't force businesses to collect sales taxes unless the businesses have operations in that state. The court also said Congress could lift the ban, which remains in place — for now.

As a result, generally only businesses with a "physical presence" in a state — such as a store or office building — collect sales tax on products sent to buyers in the same state. For instance, a Californian buying something from Barnes & Noble Inc.'s Web site pays sales tax because the bookseller has stores in the Golden State. Buying the same thing directly from Amazon would not ring up sales tax.

That doesn't mean products purchased online from out-of-state companies are necessarily tax-free. Consumers are usually supposed to self-report taxes on these items. This is called a use tax, but not surprisingly, it tends to go unreported.

In hopes of unraveling the complex tax rules — and bringing states more money — 22 states and many brick-and-mortar retailers support the efforts of a group called the Streamlined Sales Tax Governing Board. The group is getting states to simplify and make uniform their numerous tax rates and rules, in exchange for a crack at taxing online sales.

Among other things, participating states need to change how they define things such as "food" and "clothing." For example, one state might now consider a T-shirt clothing and tax it as such, while another might consider it a sporting good and tax it differently.

In response, more than 1,100 retailers have registered with the streamlining group and are collecting sales taxes on items shipped to states that are part of the agreement — even if they are not legally obligated to.

The streamlining board also is lobbying Congress to let the participating states do what the Supreme Court ruling banned: They could force businesses to collect taxes on sales made to in-state customers, even if the businesses don't have a physical presence there.

New Jersey, Michigan and North Carolina are among the largest of the 19 states that have adjusted their tax laws to fully comply with the group's streamlined setup. Washington was the only state to join in 2008, but three more states are close to becoming full members of the group. And Scott Peterson, the group's executive director, expects another seven states — including Texas, Florida and Illinois — to introduce legislation in January that would make them eligible to join.

Undoing the patchwork can be difficult, even if the weak economy increases states' motivation to go after online sales taxes. Similar bills have been introduced in several states and failed, sometimes because of the cost of changing tax laws. New York, for example, decided against joining the streamlining board because it would require extensive revisions to its tax rules.

Besides various states and retailers such as Wal-Mart Stores Inc., Borders Group Inc. and J.C. Penney Co., the National Retail Federation, the industry's biggest trade group, also supports the Streamlined Sales Tax group.

Companies that handle Web sales only have organized as well. NetChoice, whose members include eBay Inc. and online discount retailer Overstock.com Inc., supports the states' tax simplification efforts, but its executive director, Steve DelBianco, says online retailers should have to collect taxes only in states where they have a physical presence.

But what if the meaning of "physical presence" is changed? New York essentially did that in April when its budget included a provision requiring online retailers like Amazon to collect taxes on purchases made by New Yorkers.

The new rule requires retailers to collect sales tax if they solicit business in New York by paying anyone within the state for leading customers to them. Since some Web site operators within New York are compensated for posting ads that link to sites like Amazon, the online retailers would have to collect taxes.

Matt Anderson, spokesman for the New York State Division of the Budget, said the state expects to reap $23 million during the current fiscal year, which ends March 31, from newly collected online sales taxes.

That's a sliver of the overall state budget for the same period, which is $119.7 billion. The state faces a revenue gap of $1.7 billion.

Yet Anderson said the state wants "to level the playing field and end the "unfair competitive advantage" Web-only companies have over brick-and-mortar stores that can't avoid collecting sales taxes.

Amazon complies, and collects sales taxes on shipments to New York. However, Amazon is still fighting the rule. It sued New York in April, alleging its provision is unconstitutional. Amazon also said it is being specifically targeted by the law. The case is pending.

Amazon declined further comment.

Salt Lake City-based Overstock is also suing New York over the law. Unlike Amazon, Overstock is not collecting sales tax in New York, because it ended agreements with about 3,400 affiliates in the state that were being paid for directing traffic to Overstock.com.

The Streamlined Sales Tax group hopes Congress takes up its uniform-tax idea in 2009. Peterson thinks the dismal economy boosts the chances of passage.

But Congress also will be occupied with economic stimulus plans involving bigger pools of money. And Mulpuru, the Forrester Research analyst, notes that for years there has been talk of taxing online retailers.

But those tax breaks are starting to erode. With the recession pummeling states' budgets, their governments increasingly want to fill the gaps by collecting taxes on Internet sales, which are growing even as the economy shudders.

And that is sparking conflict with companies that do business online only and have enjoyed being able to offer sales-tax free shopping.

One of the most aggressive states, New York, is being sued by Amazon.com Inc. over a new requirement that online companies must collect taxes on shipments to New York residents, even if the companies are located elsewhere. New York's governor also wants to tax "Taxman" covers and other songs downloaded from Internet services like iTunes.

The amount of money at stake nationwide is unclear; online sales were expected to make up about 8 percent of all retail sales in 2008 and total $204 billion, according to Forrester Research. This is up from $175 billion in 2007.

Based on that 2008 figure, Forrester analyst Sucharita Mulpuru says her rough estimate is that if Web retailers had to collect taxes on all sales to consumers, it could generate $3 billion in new revenue for governments.

It's uncertain how much more could come as well from unpaid sales taxes on Internet transactions between businesses. But even with both kinds of taxes available, state budgets would need more help. The Center on Budget and Policy Priorities estimates that the states' budget gaps in the current fiscal year will total $89 billion.

Collecting online sales taxes is not as simple as it might sound. A nationwide Internet business faces thousands of tax-collecting jurisdictions — states, counties and cities — and tangled rules about how various products are taxed.

And a 1992 U.S. Supreme Court ruling said that states can't force businesses to collect sales taxes unless the businesses have operations in that state. The court also said Congress could lift the ban, which remains in place — for now.

As a result, generally only businesses with a "physical presence" in a state — such as a store or office building — collect sales tax on products sent to buyers in the same state. For instance, a Californian buying something from Barnes & Noble Inc.'s Web site pays sales tax because the bookseller has stores in the Golden State. Buying the same thing directly from Amazon would not ring up sales tax.

That doesn't mean products purchased online from out-of-state companies are necessarily tax-free. Consumers are usually supposed to self-report taxes on these items. This is called a use tax, but not surprisingly, it tends to go unreported.

In hopes of unraveling the complex tax rules — and bringing states more money — 22 states and many brick-and-mortar retailers support the efforts of a group called the Streamlined Sales Tax Governing Board. The group is getting states to simplify and make uniform their numerous tax rates and rules, in exchange for a crack at taxing online sales.

Among other things, participating states need to change how they define things such as "food" and "clothing." For example, one state might now consider a T-shirt clothing and tax it as such, while another might consider it a sporting good and tax it differently.

In response, more than 1,100 retailers have registered with the streamlining group and are collecting sales taxes on items shipped to states that are part of the agreement — even if they are not legally obligated to.

The streamlining board also is lobbying Congress to let the participating states do what the Supreme Court ruling banned: They could force businesses to collect taxes on sales made to in-state customers, even if the businesses don't have a physical presence there.

New Jersey, Michigan and North Carolina are among the largest of the 19 states that have adjusted their tax laws to fully comply with the group's streamlined setup. Washington was the only state to join in 2008, but three more states are close to becoming full members of the group. And Scott Peterson, the group's executive director, expects another seven states — including Texas, Florida and Illinois — to introduce legislation in January that would make them eligible to join.

Undoing the patchwork can be difficult, even if the weak economy increases states' motivation to go after online sales taxes. Similar bills have been introduced in several states and failed, sometimes because of the cost of changing tax laws. New York, for example, decided against joining the streamlining board because it would require extensive revisions to its tax rules.

Besides various states and retailers such as Wal-Mart Stores Inc., Borders Group Inc. and J.C. Penney Co., the National Retail Federation, the industry's biggest trade group, also supports the Streamlined Sales Tax group.

Companies that handle Web sales only have organized as well. NetChoice, whose members include eBay Inc. and online discount retailer Overstock.com Inc., supports the states' tax simplification efforts, but its executive director, Steve DelBianco, says online retailers should have to collect taxes only in states where they have a physical presence.

But what if the meaning of "physical presence" is changed? New York essentially did that in April when its budget included a provision requiring online retailers like Amazon to collect taxes on purchases made by New Yorkers.

The new rule requires retailers to collect sales tax if they solicit business in New York by paying anyone within the state for leading customers to them. Since some Web site operators within New York are compensated for posting ads that link to sites like Amazon, the online retailers would have to collect taxes.

Matt Anderson, spokesman for the New York State Division of the Budget, said the state expects to reap $23 million during the current fiscal year, which ends March 31, from newly collected online sales taxes.

That's a sliver of the overall state budget for the same period, which is $119.7 billion. The state faces a revenue gap of $1.7 billion.

Yet Anderson said the state wants "to level the playing field and end the "unfair competitive advantage" Web-only companies have over brick-and-mortar stores that can't avoid collecting sales taxes.

Amazon complies, and collects sales taxes on shipments to New York. However, Amazon is still fighting the rule. It sued New York in April, alleging its provision is unconstitutional. Amazon also said it is being specifically targeted by the law. The case is pending.

Amazon declined further comment.

Salt Lake City-based Overstock is also suing New York over the law. Unlike Amazon, Overstock is not collecting sales tax in New York, because it ended agreements with about 3,400 affiliates in the state that were being paid for directing traffic to Overstock.com.

The Streamlined Sales Tax group hopes Congress takes up its uniform-tax idea in 2009. Peterson thinks the dismal economy boosts the chances of passage.

But Congress also will be occupied with economic stimulus plans involving bigger pools of money. And Mulpuru, the Forrester Research analyst, notes that for years there has been talk of taxing online retailers.

Sunday, January 11, 2009

States with highest unemployment rates share root causes

Unlike the last recession, today's unemployment hot spots are all over the map.

The five states with the highest unemployment rates -- Michigan, Rhode Island, South Carolina, California and Oregon -- all have something in common, though: a heightened exposure to the root causes of this downward spiral.

The collapse of housing. The implosion of the auto industry. The meltdown of financial services. The exodus of manufacturing.

All states are feeling the pain, but the worst are getting hammered on multiple fronts:

-- The rotten housing market has punished California lenders and builders, taken an ax to Oregon's timber industry and soured the prospects for construction workers in Rhode Island, where buyers from neighboring states helped drive up home prices.

-- The steady decline of the manufacturing sector has punished Rhode Island and South Carolina, where laid-off factory workers lack the training and job opportunities in an increasingly high-tech economy.

-- The auto industry's pain is Michigan's above all. But it is also being felt in states like South Carolina, where German automaker BMW has cut 500 temporary workers, and in California, where many of dealerships have shut down.

"What makes this a different recession," said Rebecca Blank, an economist at the Brookings Institution, "is that it is so widespread."

During the 2001 recession, which was largely tied to the dot-com collapse, the West had a disproportionate amount of the jobless burden: Oregon, Washington, Alaska and California had the highest unemployment rates. (Mississippi and Washington, D.C. were tied with California.)

There is one region of the country that has largely avoided the country's real estate and manufacturing woes, and as a result has been spared the worst of the recession's pain.

A contiguous cluster of rural states -- Wyoming, North Dakota, South Dakota, Nebraska and Utah -- had the lowest unemployment rates in November, ranging from 3.2 percent to 3.7 percent. The Labor Department on Friday said the national jobless rate in December was 7.2 percent.

Historically high prices for energy and grains have been a boon to their economies, although recent declines in commodity prices are beginning to bite, economists said.

For the majority of the country, the air has come out of a decade-long housing bubble, with home prices falling an average of 20 percent in the past year and almost one in ten mortgages either overdue or in foreclosure. A wide swath of industries is feeling the pain, including real estate agents, bankers, builders, lumber companies and furniture makers.

The real estate bust is at the heart of mounting job losses in California, which has seen its unemployment rate reach 8.4 percent, the third-highest in the nation. In the year ending in November, 71 percent of the nonfarm jobs lost in California were housing-related.

Many of the nation's leading mortgage lenders -- Countrywide Financial, New Century Financial, IndyMac Bancorp, and Fremont General Corp. -- were based in California and have since been bought by larger banks or gone bankrupt.

The recently unemployed in California include Filemon Galvan, 41, of Buena Park, Calif., who was laid off from his job as a carpenter for a housing subcontractor in August.

"It's been a long time since we had a nice family outing," Galvan said in Spanish.

As the country's leading lumber producer, Oregon has also taken a direct hit from housing, with sawmills producing sharply less than a year ago. The slump has cost Oregon about 1,000 logging jobs in the past two years and more than 7,000 jobs in wood manufacturing, which includes plywood mills and the production of door and window frames, said David Cooke, an economist in Oregon's employment department.

Not even tiny Rhode Island, which has the nation's second-highest unemployment rate at 9.3 percent, has been exempt from the housing bust.

The slide has cost Rhode Island more than 3,000 construction jobs in the past year, according to the U.S. Labor Department.

Due to a combination of high energy prices, a strong dollar and competition from overseas, manufacturers have been manhandled for most of this decade -- and ground zero for the loss of factory jobs is Michigan. Its crumbling auto industry explains a large part of the state's nation-leading unemployment rate of 9.6 percent. Around the state, and across the country, the state's automakers have had to close plants and showrooms, cut back workers' hours and reduce wages as consumers' appetite for new cars dwindles along with their job security.

But the manufacturing slowdown has gone far beyond the industrial Midwest. South Carolina's jobless rate has reached 8.4 percent, the third-highest, as it struggles to replace lost textile and apparel manufacturing jobs with the type of high-tech industries that North Carolina has been able to attract.

And Rhode Island, not generally known as a manufacturing hub, has suffered. The industrial conglomerate Textron Inc., which is based in Providence and makes Cessna jets and Bell helicopters, laid off 2,200 of its 43,000 workers last year.

Most of the state's manufacturers are small, however, and have had a tough time weathering the credit crunch.

Lincoln, R.I. resident Larry Miller believed he would retire from the auto parts manufacturer where he first got a job as a newly married 26-year-old. That was two factory closings ago, the most recent being a plant owned by KIK Custom Products, which also had employed his wife.

"The word loyalty is gone," said Miller, shaking his head while sitting at his kitchen table. He found a new job in Massachusetts, but his wife is still looking.

Like South Carolina, the state hasn't yet made a successful transformation from manufacturing to newer-economy industries such as biotech or computing.

"I would summarize Rhode Island's economy as information age, hold the information," said Leonard Lardaro, an economist at the University of Rhode Island.

The five states with the highest unemployment rates -- Michigan, Rhode Island, South Carolina, California and Oregon -- all have something in common, though: a heightened exposure to the root causes of this downward spiral.

The collapse of housing. The implosion of the auto industry. The meltdown of financial services. The exodus of manufacturing.

All states are feeling the pain, but the worst are getting hammered on multiple fronts:

-- The rotten housing market has punished California lenders and builders, taken an ax to Oregon's timber industry and soured the prospects for construction workers in Rhode Island, where buyers from neighboring states helped drive up home prices.

-- The steady decline of the manufacturing sector has punished Rhode Island and South Carolina, where laid-off factory workers lack the training and job opportunities in an increasingly high-tech economy.

-- The auto industry's pain is Michigan's above all. But it is also being felt in states like South Carolina, where German automaker BMW has cut 500 temporary workers, and in California, where many of dealerships have shut down.

"What makes this a different recession," said Rebecca Blank, an economist at the Brookings Institution, "is that it is so widespread."

During the 2001 recession, which was largely tied to the dot-com collapse, the West had a disproportionate amount of the jobless burden: Oregon, Washington, Alaska and California had the highest unemployment rates. (Mississippi and Washington, D.C. were tied with California.)

There is one region of the country that has largely avoided the country's real estate and manufacturing woes, and as a result has been spared the worst of the recession's pain.

A contiguous cluster of rural states -- Wyoming, North Dakota, South Dakota, Nebraska and Utah -- had the lowest unemployment rates in November, ranging from 3.2 percent to 3.7 percent. The Labor Department on Friday said the national jobless rate in December was 7.2 percent.

Historically high prices for energy and grains have been a boon to their economies, although recent declines in commodity prices are beginning to bite, economists said.

For the majority of the country, the air has come out of a decade-long housing bubble, with home prices falling an average of 20 percent in the past year and almost one in ten mortgages either overdue or in foreclosure. A wide swath of industries is feeling the pain, including real estate agents, bankers, builders, lumber companies and furniture makers.

The real estate bust is at the heart of mounting job losses in California, which has seen its unemployment rate reach 8.4 percent, the third-highest in the nation. In the year ending in November, 71 percent of the nonfarm jobs lost in California were housing-related.

Many of the nation's leading mortgage lenders -- Countrywide Financial, New Century Financial, IndyMac Bancorp, and Fremont General Corp. -- were based in California and have since been bought by larger banks or gone bankrupt.

The recently unemployed in California include Filemon Galvan, 41, of Buena Park, Calif., who was laid off from his job as a carpenter for a housing subcontractor in August.

"It's been a long time since we had a nice family outing," Galvan said in Spanish.

As the country's leading lumber producer, Oregon has also taken a direct hit from housing, with sawmills producing sharply less than a year ago. The slump has cost Oregon about 1,000 logging jobs in the past two years and more than 7,000 jobs in wood manufacturing, which includes plywood mills and the production of door and window frames, said David Cooke, an economist in Oregon's employment department.

Not even tiny Rhode Island, which has the nation's second-highest unemployment rate at 9.3 percent, has been exempt from the housing bust.

The slide has cost Rhode Island more than 3,000 construction jobs in the past year, according to the U.S. Labor Department.

Due to a combination of high energy prices, a strong dollar and competition from overseas, manufacturers have been manhandled for most of this decade -- and ground zero for the loss of factory jobs is Michigan. Its crumbling auto industry explains a large part of the state's nation-leading unemployment rate of 9.6 percent. Around the state, and across the country, the state's automakers have had to close plants and showrooms, cut back workers' hours and reduce wages as consumers' appetite for new cars dwindles along with their job security.

But the manufacturing slowdown has gone far beyond the industrial Midwest. South Carolina's jobless rate has reached 8.4 percent, the third-highest, as it struggles to replace lost textile and apparel manufacturing jobs with the type of high-tech industries that North Carolina has been able to attract.

And Rhode Island, not generally known as a manufacturing hub, has suffered. The industrial conglomerate Textron Inc., which is based in Providence and makes Cessna jets and Bell helicopters, laid off 2,200 of its 43,000 workers last year.

Most of the state's manufacturers are small, however, and have had a tough time weathering the credit crunch.

Lincoln, R.I. resident Larry Miller believed he would retire from the auto parts manufacturer where he first got a job as a newly married 26-year-old. That was two factory closings ago, the most recent being a plant owned by KIK Custom Products, which also had employed his wife.

"The word loyalty is gone," said Miller, shaking his head while sitting at his kitchen table. He found a new job in Massachusetts, but his wife is still looking.

Like South Carolina, the state hasn't yet made a successful transformation from manufacturing to newer-economy industries such as biotech or computing.

"I would summarize Rhode Island's economy as information age, hold the information," said Leonard Lardaro, an economist at the University of Rhode Island.

Tuesday, January 6, 2009

German tycoon Adolf Merckle commits suicide

German billionaire Adolf Merckle has committed suicide, in despair over the huge losses suffered by his business empire during the financial crisis, his family said on Tuesday.

The media-shy billionaire, whose family controls some of Germany's best-known companies, was hit by a train on Monday evening, local officials said.

"The desperate situation of his companies caused by the financial crisis, the uncertainties of the last few weeks and his powerlessness to act, have broken the passionate family entrepreneur and he took his own life," a family statement said.

State prosecutors from the southern city of Ulm said Merckle, 74, left work on Monday and died after being hit by a train near the town of Blaubeuren. He left behind a suicide note to his family, they added.

There was no sign of anyone else being involved, they said.

In 2008 Merckle was ranked as the world's 94th-richest person and Germany's fifth-wealthiest by Forbes magazine.

On Tuesday pale blood stains still dotted the snow along the railway track where he died. The area looked deserted apart from a police car nearby.

Merckle, a father of four, inherited the basis of his fortune from his Bohemian grandfather, but went on to build up the chemical wholesale company into Germany's largest drugs wholesaler.

The passionate skiier and mountain climber assembled a business conglomerate with about 100,000 employees and 30 billion euros ($40.45 billion) in annual sales.

His family controls a number of German companies including cement maker HeidelbergCement and generic drug company Ratiopharm.

But the empire was rocked last year by wrong-way bets made on shares in Volkswagen after a surprise stakeholding announcement from Porsche sent the VW share price rocketing as short sellers scrambled to cover their positions.

Banking sources had told Reuters the family lost hundreds of millions of euros on investments, with about 400 million euros lost on Volkswagen shares alone.

Since then the family has been in talks for weeks with banks to renegotiate loans. Banking sources said on Tuesday his death was not expected to affect loan agreements with the family.

Shares in HeidelbergCement fell as much as 12.5 percent following the news of Merckle's death and ended the day down 6.2 percent at 31.25 euros.

"Some investors are afraid that there will be no one to lead negotiations during this sensitive situation for the company," one trader in Frankfurt said.

Psychologists and other mental health experts have said suicide rates could creep up as a result of the financial crisis.

Last month Frenchman Thierry Magon de la Villehuchet, 65, a co-founder of money manager Access International, was found dead in a New York office building, reportedly distraught over losing up to $1.4 billion in client money to Bernard Madoff's alleged fraud. He slit his wrists with box cutters.

Labels:

Adolf Merckle,

bernard madoff,

finance,

financial crisis,

financial news,

Merckle

Friday, January 2, 2009

Mortgages: What You Need to Know in 2009

You have to go back to around 1961 to find a time when 30-year mortgages had rates this low, according to Keith Gumbinger, a vice-president at financial publisher HSH Associates in Pompton Plains, N.J. For that, thank the U.S. government, which is trying to jump-start the stalled housing market by buying up mortgage-backed securities.

Rates are probably headed even lower in 2009, raising the question of whether you should borrow now or wait for a better deal. The experts are sharply divided over this one. Put it this way: If you're a gambler, wait. If you can't sleep at night worrying that rates will go up from here, borrow now.

Here are some key things you need to know about today's mortgage market:

Now More Than Ever, Shop Around

In ordinary times, one loan is about as good as another because most lenders' offers on 30-year loans are clustered within around a quarter of a percentage point. Not now. With the economy so shaky, lenders are all over the map in how much risk they're willing to take in making loans. So it really pays to shop around. And keep checking, because rates are constantly changing. One day in late December 2008, Wells Fargo was offering 30-year conforming loans at 5.0% plus one point, while Bank of America was offering the same kind of loan at 6.625% plus one point, according to Cameron Findlay, chief economist of LendingTree.com, a division of Home Loan Center. No offense to Bank of America, but only a sucker would have borrowed from it instead of Wells Fargo that day.

For New Loans, Get a Fixed Rate